Have you ever heard about stock market options, people making outsized gains and wondered what they are? Perhaps you understand the basics of what options are but have never placed an options trade.. Or you placed a few options trades with disastrous results. If you find yourself in one of those categories this article is for you.

What is an option or stock option?

A stock option is a contract that allows you to buy or sell stock at a fixed price. Call options allow you buy, while Put options allow you to sell. The option is yours in that it is your choice if you buy or sell, sort of. Most brokers will assume that if you are holding an option at expiration, that you will want to exercise that option if it has value. You can call the broker and ask them not to do this for your account. Most stock options are considered American style option. This means that you do not have to wait for expiration to exercise the option. An American option can be exercised at any time up to and including expiration.

You may be asking yourself now, if I have no intention to buy or sell stock, then why would ever want to buy a stock option? That is a valid question based on the definition above, which is the technical definition, however let me give you a different definition. An stock option is a contract that allows you to make a leveraged bet on the price movement of an underlying stock in the future. This is how most traders view options. As that is the case we will leave behind now the relationship of buying and selling stock with options, as the vast majority of options trades never result in stock bought or sold, in fact most options expire worthless.

What is the value of a stock option?

At this point most people become confused, you told me an option was a contract to buy or sell stock, but if I am not planning to buy or sell the stock then how does the option have any value? Or why would I buy an option if I never intend to buy or sell the stock. The truth is that options have value in their own right. That value is based on the probabilistic potential for that option to have a profitable value at expiration. There is a very complicated formula called the Black Scholes model which is used as the basis of most options pricing, though this formula is really only the base price, and the real price is whatever the market is willing to buy or sell the option for.

In order to explain better what the value of an option is, I need to cover a few definitions first, that are used to describe an option position.

Definitions

- Strike

- The contractual price where the option will transact if exercised.

- Expiration

- The final date that the option contract can be transacted on, after this date the contract become null and void.

- Call Option

- A contract that allows you to buy a stock at a fixed price in the future.

- Put Option

- A contract that allows you to sell a stock at a fixed price in the future.

- ATM – At the money –

- This describes an option whose strike price is very near the current price of the underlying stock. If AAPL is trading at 145.70, at 145 or 146 strike would be considered “at the money”.

- ITM – In the money

- This describes an option whose strike price would have value if the option were to expire now. For a call option, an ITM option would have a strike below the current trade price of the underlying. A put option, that is ITM, will have a strike above the current underlying price.

- OTM – Out of the money

- This describes and option which would be worthless if the option were to expire now. For a call option this would be a strike higher than the stock price and a put option would have a price below the current strike price.

- Intrinsic Value

- The dollar difference between the option strike and underlying that is in the money. If I have an OTM option, it has $0 intrinsic value. This is the value the option would have if it were expiring right now.

- Extrinsic Value

- The dollar difference of the price of the option, less the intrinsic value. An out of the money option this only has extrinsic value. For an option that is ITM, this is the full option cost less the intrinsic value. This is the speculative value the market puts on the option.

What is the Value?

With that out of the way we can now say the value of an option is the sum of its intrinsic and extrinsic value. Stated differently the value of an option is the value it would have if it expired right now, plus the speculative value the market has placed on the contract, the amount the market expects the underlying stock to move. Ultimately however, the real value of an option is the price that someone is willing to pay right now in order to have that contract, nothing else really matters the black scholes formula, the greeks (we’ll get there), the intrinsic and extrinsic value, these only help to say what the market should be willing to pay and they do not always accurately predict what someone will pay.

The Options Chain

And now that we have covered that, we need to know how do we find out the value of an option contract. This is represented as a schedule of strikes and values expressed as bid and ask for each expiration called the options chain. When you are buying or selling an option you will generally use the option chain to find the current price and make the transaction.

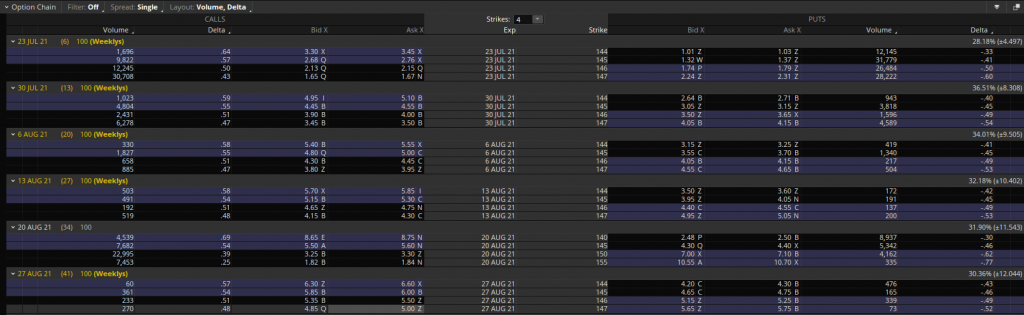

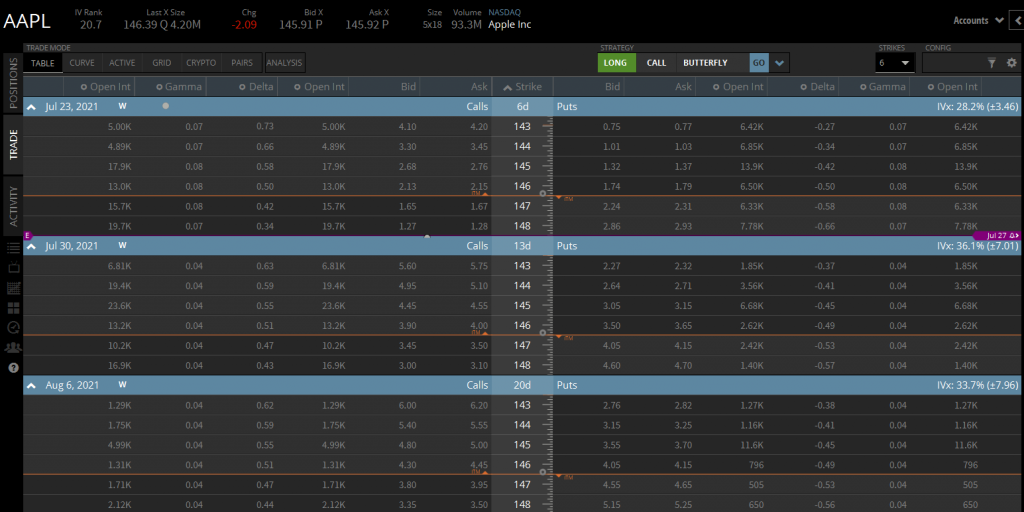

TD Ameritrade (TOS) Options Chain for AAPL on 7/17/2021

Fidelity (Active Trader Pro) Options Chain for AAPL on 7/17/2021

Tastyworks Options Chain for AAPL on 7/17/2021

As you can see each brokerage has its own view of the options chain, but generally they are the sameish. This is can be immediately overwhelming. At least I was, and now I mentor and teach people about trading options. When I first decided I wanted to find out about these options I started reading and then found the options chain in Fidelity online and immediately freaked out. It was almost a decade later before I came back to the subject, at which point I paid someone thousands of dollars to teach me what I am spelling out in this blog for free. I deeply regret that I did not continue to pursue options trading at that time and set my future on a very different trajectory than where I was ten years later. I hope you will push past the learning curve as well.

Breaking Down the Options Chain

Yep more definitions, some you may be familiar with, others you will not.

- Ask

- The current lowest price that someone is willing to pay for the option contract. This is the price you would pay if you wanted to immediately buy and placed a market order to buy.

- Bid

- The current highest price that someone is willing to pay for the option contract. This is the price you would get if you wanted to sell immediately and placed a market order to sell.

- Bid/Ask Spread or just Spread

- The difference between the Bid and Ask price of the option contract. In very liquid options (lots of people trading) the bid ask spread will be very narrow, often only one or two pennies.

- It is critical to understand this as if you purchase at market the value of your option immediately after the purchase will be the Bid price, but you will pay the asking price.

- I have literally taken an immediate 50% loss on a purchase of an option when I was not paying attention to the spread. For instance the bid was $0.30 and the ask was $0.60.

- When starting you must stick to options that have a narrow bid ask spread or you will take heavy losses.

- Bidsize, Asksize

- the number of contracts on offer at the Bid or Ask. An order that is larger than this value will change the price of the option, as it will push the price to the next bid or ask value, this can be a drastic change. Just yesterday I saw changes of $15 to $25 due to someone exhausting the asksize @ $15, and the next closest ask being $25.

- Open, High, Low, Last

- The options relative price within the current session of trade. I.E. the highest, lowest, opening, or last value of the option during the current trading session.

- Volume

- The number of options that have been bought or sold during the day.

- Open Interest

- The total number of current contracts that exist for this underlying at this strike price for this expiration of this option type.

- You should aim to trade the highest open interest strikes to insure the highest levels of liquidity.

- You should avoid trading any option contract with less than 1000 open interest when you are starting, even with several years of experience I avoid contracts of less than 100 open interest and I do trade options on stocks that do not have high overall open interest.

- Delta, Theta, Gamma, IV, IV%,

- These are the Greeks and the definitions of these will be the topic of many other articles.

- Theo(retical), Touch%, ITM%, OTM%

- Helpful probabilities, mostly for beginners, that mostly serve to add further confusion to someone who is already struggling to tread water.

The key things you need to look at when buying or selling is bid, ask, bid/ask spread, open interest, strike and expiration. If you are lost at this point, I recommend that you go back to the start of this article and reread to this point until it you are no longer lost. After a few reads, if you are still lost, reach out to me on Twitter, @slingintrades. At this point you may find yourself wanting to recklessly make your first options trade, generally you just click on the ask price and “buy to open”. Make sure the value you are paying is an amount you are willing to lose.

How much does the contract cost?

Pricing of an options contract is confusing at first but quickly becomes second nature. The challenge is that options are listed with the per share price. Contracts however are only sold in blocks of 100 shares. So the simple answer is that you multiply the price on the options chain by 100. An option listed at $0.15 will cost $15 plus fees per contract. An option listed at $1.10 will cost $110 per contract.

When some see these very cheap options contracts they get excited and want to buy these options that cost $15/contract. Be aware you get what you pay for when it comes to options. Buying more expensive options improves the probabilities significantly. Cheap options care exponentially greater risk. These cheap options often only turn a profit 5% of the time. This will make more sense as you study the greeks.

How Do I Make (or lose) Money Trading Options

Many people that have not been involved trading options think that the contracts are always bought and held to expiration. This is not the case. Just like shares of a stock are bought and sold, options contracts are bought and sold. As price of the underlying stock moves, the value of the option contract will move, usually in an exaggerated fashion.

A 1% move in a stock can have a 10%-100% impact on the price of the options contracts. A 5 or 10% move of the underlying stock can have a 100%-2000% impact on the price of the options. So catching a solid move in the stock, can gross a very nice return in the options. Call options allow you to make money as the stock goes up. Put options allow you to make money as the stock drops. There are advanced strategies that will make money while the price remains stable, or does not wander too far. Liquid option contracts can be bought and sold any time the market is open. However, trade they do not trade during extended trading hours.

Many lose money trading options. The typical movement of the stock is already priced in to the cost of the options contract. Money is only made when an exaggerated or unexpected move is made. Many make the mistake of thinking trading options during earnings will allow them to catch the unexpected move. Option sellers are wise to this, and the price of the options become very inflated before the earnings. Inflated prices improve the odds that the option seller will not lose money when you buy their contract. You see the option seller gets to keep all the money if they option contract is never exercised.

There are a number of other factors that impact the price of options, generally referred to as “The Greeks”. You do not need to know the greeks to get started. But to really understand and control your financial success, you will need to have at least a basic understanding. That however is a topic for a different post.

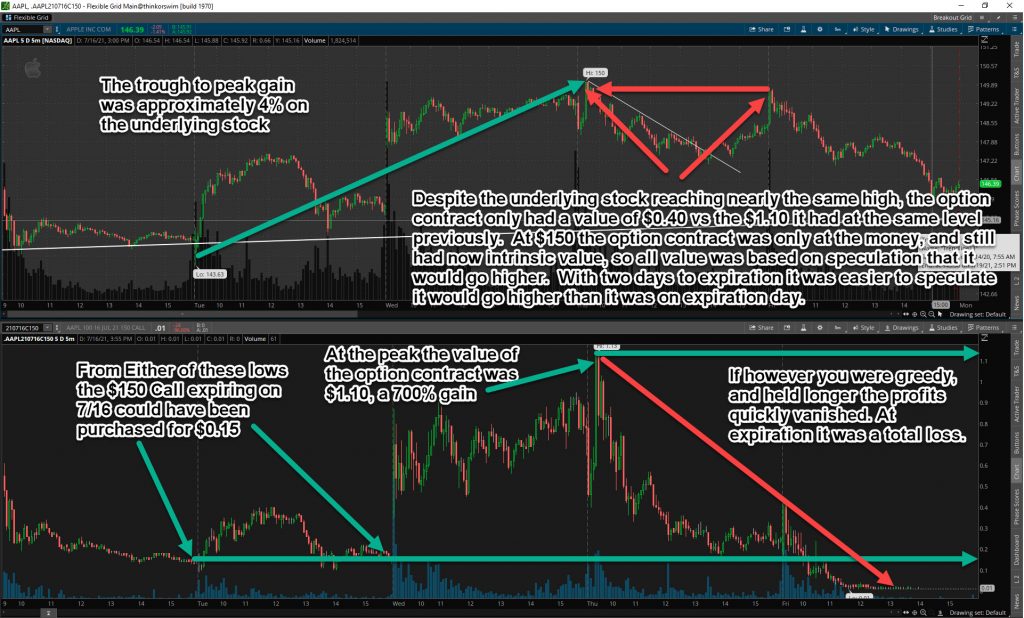

Example Call Option Performance

The above example illustrates how you could have made 700% on a 4% move over 2 days in AAPL. That same call option would have been a 100% loss if you held it to expiration. Options have explosive returns during burst of price movement for the underlying. Overtime however, most options contracts are not profitable. As an option trader we must identify times where such bursts are likely and manage our positions. It is possible to make consistent gains trading stock options.

Position Sizing

When trading options position sizing is critical due to the increased risk these positions carry. Please read more about sizing for options trading.

Sizing Options Positions

Want To Learn More?

I assist in moderating a Discord channel dedicated to trading options. The group is led by a lifelong trader with decades of experience. You can find him on Twitter @trade_likeme. Some of the trades we make are posted on Twitter @EliteTradingInc. And you can find out more or join us at EliteTrading.io.