May 2021 in review

First Major Price Swing

This is a review of the price action from the Month of May 2021 into the beginning of June. I plan to start doing these on a regular basis both for myself and for others. May is particularly inspiring as it provided many 10x opportunities, if you were bold in your option selection. Being more conservative there were countless opportunities for 100% gains.

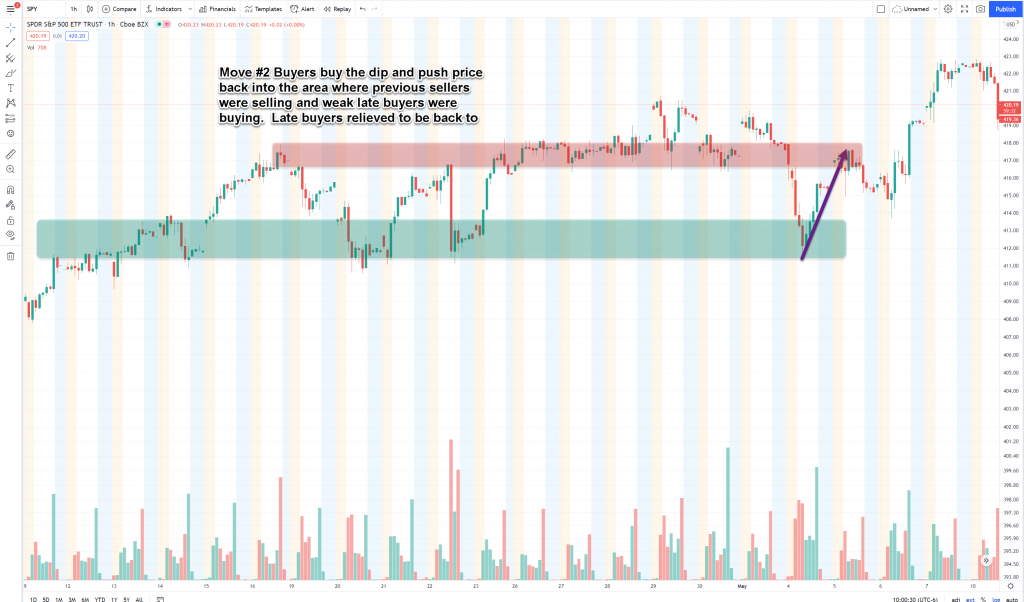

When liquidation(selling) comes in we should look for areas of previous support or consolidation. If selling slows in these areas, it is a sign that the area will act as support. A push back above such an area is common and can be a very large move, if the liquidation was large.

Second major price swing

Just like the move into support, but the opposite, a move into resistance is a sign of caution and could cause a reversal. It is best to exit longs and wait for confirmation of direction from this region in the form of a continued move above, or a breakdown back below.

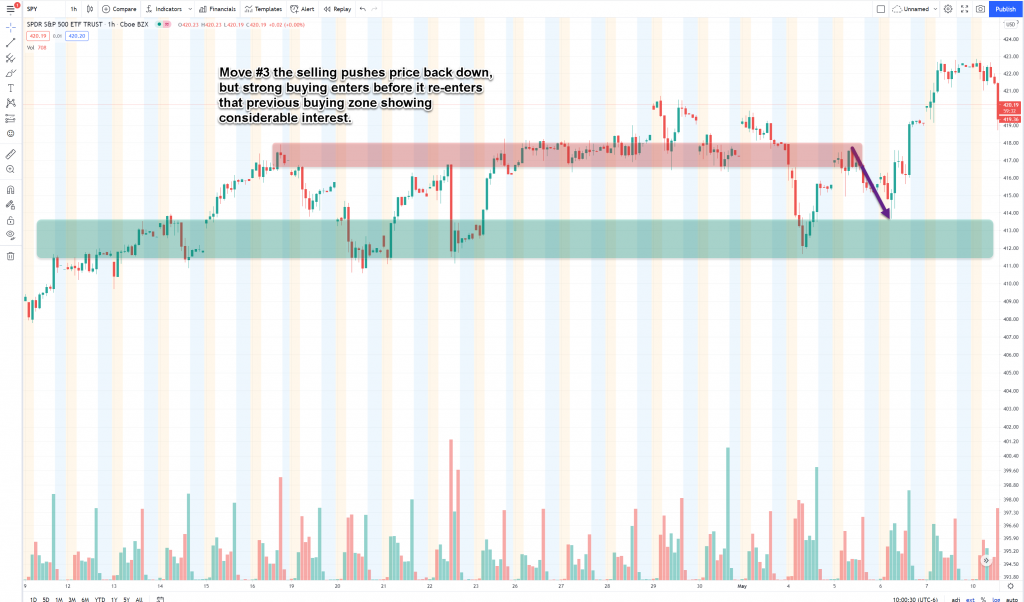

This type of move after two much larger moves, provides a potentially lucrative entry, with good risk to reward. The selling lost steam at a higher low, above the prior support area. When this happens we should look to take long entries.

Third Major Price Swing – Trendline Rejection

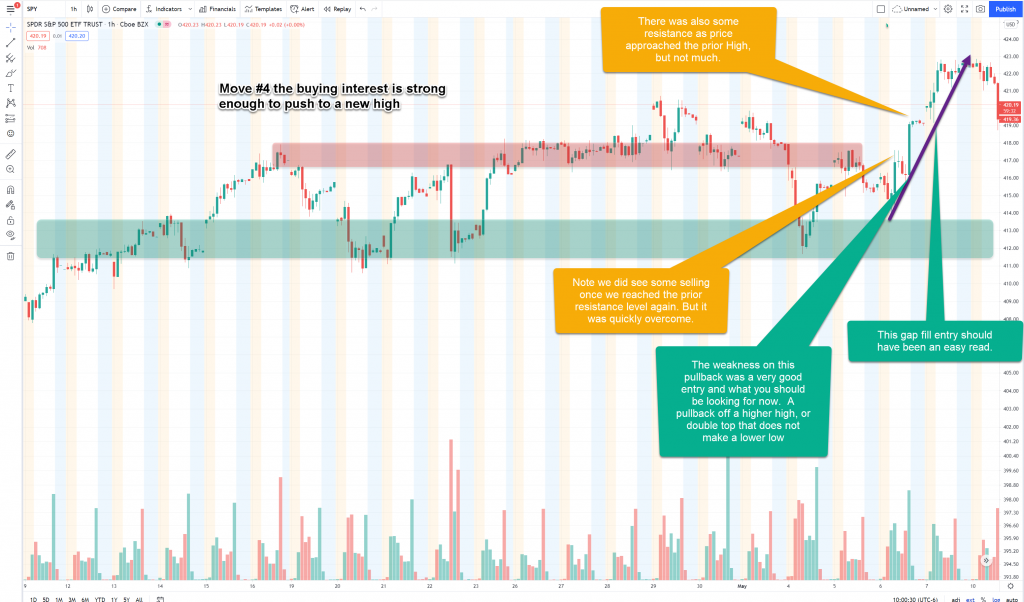

The strength continues, this push broke through the prior resistance area creating a short term higher high after a lower low. Long entries above that resistance area cutting if the resistance fail.

The bounce continued all the way to the trendline, and then started to consolidate. As soon as this consolidation area broke, it should be seen as a rejection of the big push up which could lead to a full retracement of the move, which happened in this case.

A traders bounce at the prior low. This prior low would be a good cautious long, but weakness at the top of the support band should be a signal to exit as this is a likely spot for the move down to continue. Given the push up above the larger consolidation range had failed, it makes sense that this could retrace lower.

And retrace lower it did, the rejected gap fill and weakness at the top of the consolidation range were signals of this coming move.

This large move down brings us to an area of support that was established a month before. This is notable and interesting, as this was not what I would have considered strong support, but stopped a very strong move down. Such a discrepancy is a sign that the market was done with the move down and just needed a reasonable stopping point, for a strong reversal, which came.

The reversal drives price up through resistance with strength, though a little push and pull at resistance, but ultimately closes the gap that previously did not fill before losing strength, and again driving down.

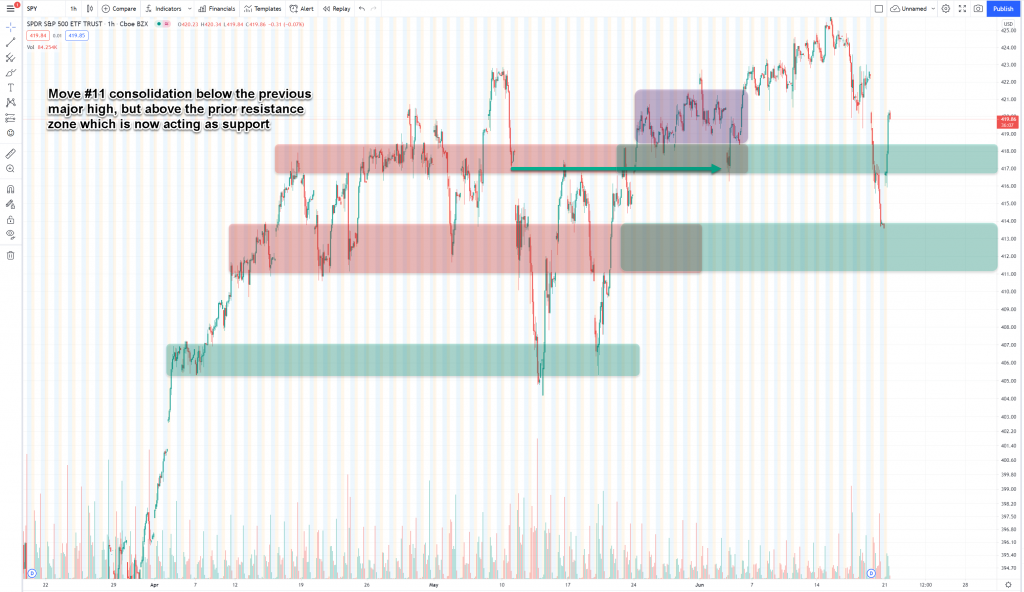

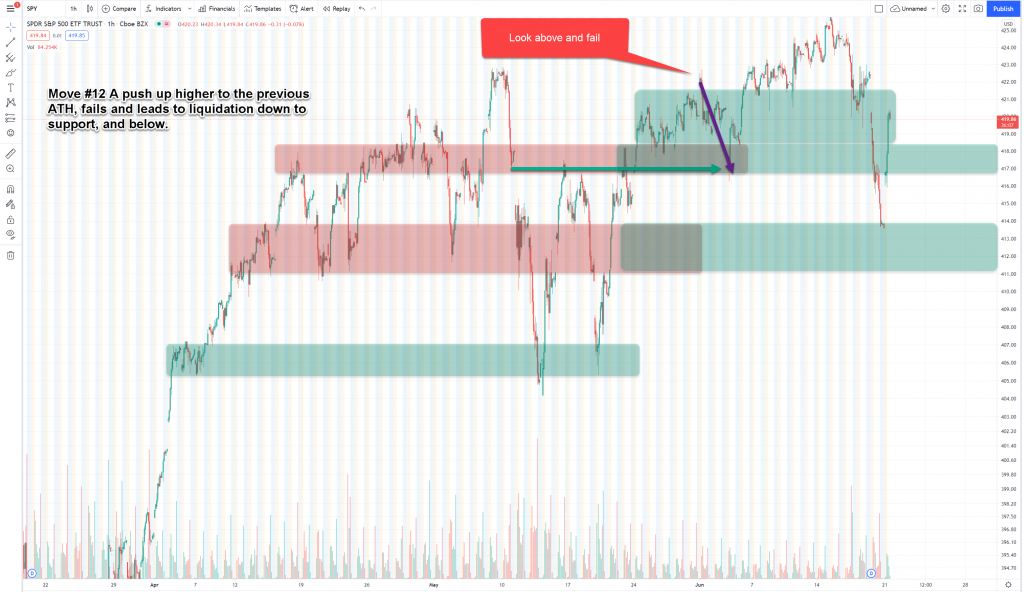

Fourth Consolidation into a new All Time High

See Move #4 above, where price drove down to resistance, but did not make a lower low and showed strength at the top of the resistance band. Like then, this again triggered a very strong move higher, making a new higher high in the shorter term.

Having found acceptance back in the previous spike that created the ATH, price consolidates. These periods can be very stressful, but provide many opportunities, if you are not searching for a break out. Remember breakouts are not the norm, consolidation is the typical pattern.

Again after a look above that fails to make a new ATH, price rejects across the consolidation range and lower. These moves that break above a consolidation range, and back into it are great opportunities for trades expecting price to go to the lower end of the consolidation range.

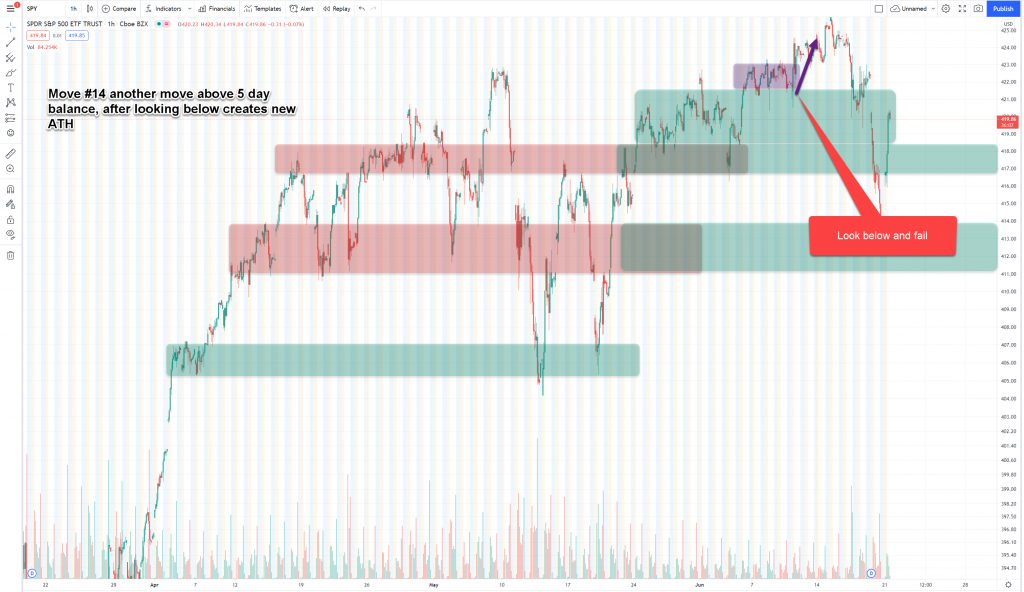

The selling ends as expected in the support region just below the consolidation. Once price returns into the consolidation region like the move down you have an excellent reason to expect a move back to the top of the region. In this case you even got a retest entry at the bottom of the consolidation region after the look below failed.

The final period of consolidation in the top of the spike, validating both the original spike as well as the look above, that previously failed, indicates a setup for an eventual long. The challenge is to remember to let the consolidation play out and not be thinking every day is a breakout run.

Conclusion

I hope that this analysis can help you in your future trading as this period illustrates a number of very strong patterns that will repeat on an ongoing basis forever. Learn the patterns, and eliminate emotion in your trading, and you will find success.