One option strategy worth considering is the Risk-Reversal. In this strategy, A long call is purchased and a short put is sold to cover the cost of the long call. This incurs a bit of a buying power premium, relative to the cost of the stock. The advantage to this setup is that it neutralizes the effects of theta, the loss typically associated with holding options for long period of time. The trade off for neutralizing theta is a much higher buying power penalty. This trade also amplifies delta. The resulting trade has a near linear P&L curve, much like holding shares, but at a fraction of the cost of holding shares.

I am going to analyze this using a relatively cheap stock HL, a silver related stock which could see a large move over the next year, if silver continues it’s trend. This stock has a pretty limited option chain, and where the stock price is only 6.24, it is questionable if it is worth using an option strategy or just buying the stock would be better.

Modifying the risk-reversal slightly will substantially reduce the buying power requirement. Because of the cost of the stock here, it does not have as large an impact as it would on a more expensive stock. This also much more tightly defines the risk. The modification adds a cheaper OTM put to the short put. In effect you sell a short put spread to cover the cost of a long call.

The analysis will compare purchasing shares against the risk reversal. Also examined in comparison will be the use of a long call, a hedged risk-reversal, a calendar, and a bullish diagonal.

The Trades

Here are the following trades that will be examined.

Shares

Buying 100 shares at $6.24/share.

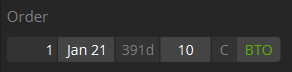

Long Call

Buying a $10 call expiring 1/21/2022 for $1.02

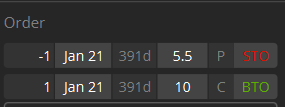

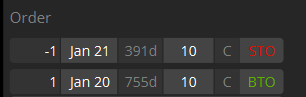

Risk-Reversal

Buying a $10 call expiring 1/21/2022 for $1.02

Selling a $5.50 put expiring 1/21/2022 for $1.31

Net $0.41Credit $209 buying power

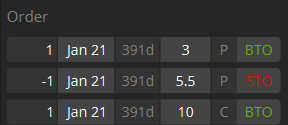

Hedged Risk-Reversal

Buying a $10 call expiring 1/21/2022 for $1.02

Selling a $5.50 put expiring 1/21/2022 for $1.31

Buying a $3 put expiring 1/21/2022 for $0.32

Net $0.12 Credit $238 buying power

Calendar

Buying a $10 call expiring 1/22/2023 for $1.95

Selling a $10 call expiring 1/21/2022 for $0.94

Net $0.63 debit, $63 buying power

(spread prices make net a little different than expected.)

Diagonal

Buying a $7 call expiring 1/22/2023 for $2.53

Selling a $10 call expiring 1/21/2022 for $0.94

Net $1.40 debit, $140 buying power

The Greeks

With our trades to compare laid out lets start some analysis. Tastworks estimated the value at a given price and time. These Estimates are theoretical. They only compare and illustrate how differently structured trades might react to a theoretical price move over a time period. The actually future pricing can be drastically different as the market changes sentiment. This information is for education only. These are not trade recommendations.

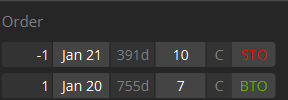

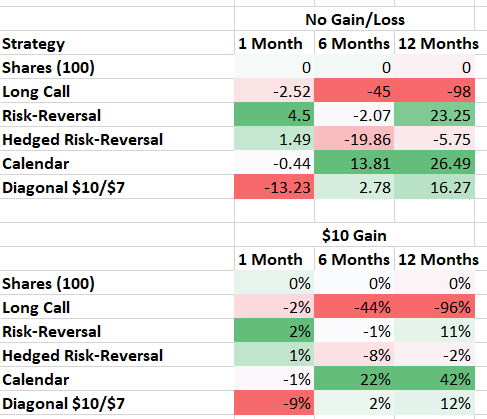

Starting with the basic greeks, buying the stock of course has a delta of 1. We can see that the risk reversal has the highest delta and lowest theta aside from buying the stock itself. The difference in delta vs buying the stock makes the risk-reversal much more cost effective when considering the required buying power for each position. Even if purchasing shares on 2:1 margin, the risk-reversal is still a stronger position in terms of delta, with minimal theta decay.

The calendar and diagonal are notable in terms of theta as well. They come with much less delta, the power for the position to grow in value with stock moving. That said the capital requirements and max loss on the calendar and diagonal are among the lowest. Delta would benefit by increasing position size to equalize buying power. That said we are primarily going to focus on % return on capital. The long call has relatively high delta, but the theta is the highest. The Hedged risk-reversal strikes a balance when it comes to delta and theta.

When looking for an option setup, that will be held for some amount of time we want to minimize the ratio of theta to delta. This is the minimum price the stock must move each day before the position starts to lose value. The long call has the highest theta/delta score requiring a $0.60 move per day to stay afloat. The risk reversal only requires a $0.05 move per day to stay even. The theta from the calendar and diagonal are positive values meaning they will make some money over time, the longer we hold the greater the potential to profit is.

Profit and Loss

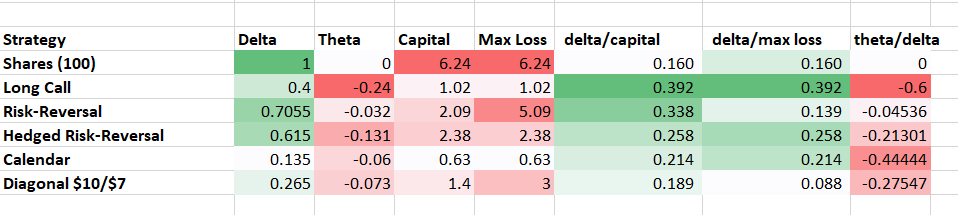

Lets start first with examining what will happen if there is no change in price for the underlying to each of the strategies.

No Change in price

The shares of course we have no gain or loss. The long call takes deep losses as time progresses towards expiration. These other strategies, either have modest gains or losses over time, where the calendar actually has a decent return with no change in the underlying value. This is why these strategies are being compared here, they are all designed to enable a longer hold without the position suffering from heavy decay.

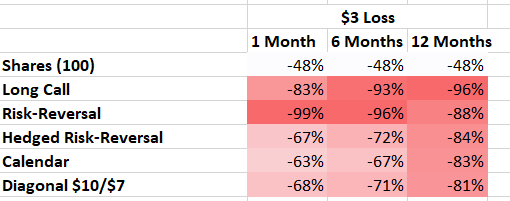

Now lets take a look at the bad scenario. What happens if we loose $3 in underlying value (almost 50%) over 1,6 or 12 months.

-$3 in value

Needless to say if the stock takes a 50% dive, we are going to take a big hit on our option strategies. Once again the Calendar and Diagonal show the smaller losses, along with the hedged risk-reversal, hence the hedge, but as we draw close to expiration all near a full loss.

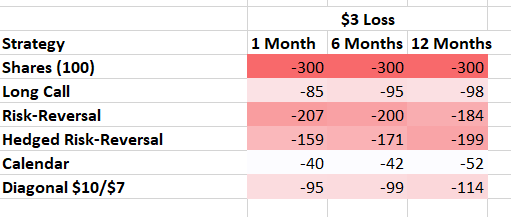

One might ask why we would consider options at all then, we amplified our losses relative to buying and holding the stock.

Looking at the raw $ losses the picture is a bit more clear. When considering the calendar spread we only lost at most 1/6th the amount we would have by buying shares. The risk reversal was just over half of the loss. So while the position took a higher percentage loss, the position size was much smaller so the account took a smaller dollar loss. This is why it is critical to have appropriate sizing when you are trading option strategies.

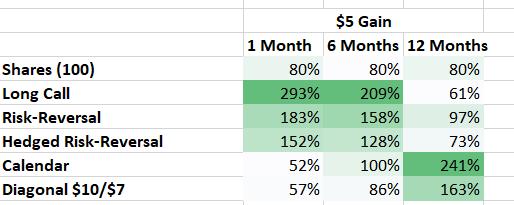

Now lets take a look at what we are really looking for, gains.

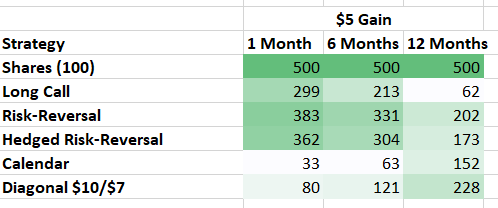

$5 gain over 1,6,12 month periods

Now we are talking, triple digit gains on that $5 move. Now this is a substantial move of the underlying, a $5 move up will nearly double the value of the stock from $6.24 to $11.24. That is a lot to ask over 1 or 6 months, or even 12 months. When considering that it might take some time to happen the calendar and diagonal become much more attractive. But if we got that fast move, the long call is king. As the $5 gain is enough to put the $10 call ITM, even on the longer term it doesn’t take a heavy loss, as it did without a price move.

Looking at the raw $ gains, the stock shares win, but they required much more buying power. Here though is where the risk-reversal begins to shine. It out paces on a percentage basis the shares gains regardless of duration. On the short term, the long call out performs, but suffers on the long term. On the long term the calendar and diagonal shine, but near term gains are lackluster.

Lets now look at the home run.

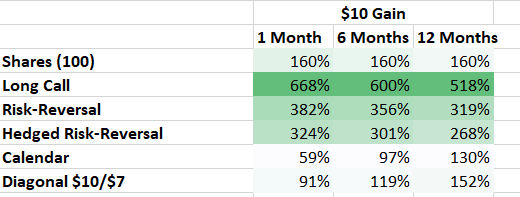

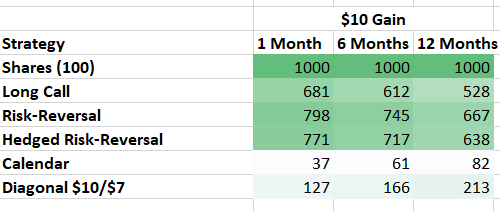

$10 gain over 1, 6, or 12 months

Now we see why the options shine, with this massive move the stock made a 160% gain, but many of the options contracts had gains that were nearly double that amount. The long call was substantially higher. The calendar and diagonal are lagging here as the size of the move was too great for the setup on those. Both had limited upside gains if the stock moves too far. Still on the 12 month, even though the move was too big, the gains were on pair with the gains in the shares.

The raw dollar gains are less impressive, but we must remember that in no case did the options tie up more than 1/3 the amount of capital that it would take to buy 100 shares of the underlying. The long call was less than 1/6th the size of the share purchase.

In Summary

I hope this analysis of a few different strategies was helpful in understanding some of the choices you have that are available when you are trading options instead of just trading shares. Some of these choices enabled you to make money even if the stock did not go up. They allowed you to limit your losses while maximizing your upside.