Active trading is risky! The market is risky!

When active trading, sizing your exposure is critical. The size of your total positions is what you have put at risk in the market. Particularly when trading options. Every option contract has the ability to go to $0 so if your entire account is in options, your entire account can go to $0. If you repeatedly expose your account with 100% exposure to options, it is inevitable that your entire account will eventually go to $0.

The size of your exposure governs your emotional state when trading. If you are oversized, you will be more likely to make emotional decisions, which are nearly always the very worst decisions at the very worst times. Are you frequently feeling like the market moves the opposite direction every time you enter or exit a position? If so, you are very likely allowing your emotions to dictate your actions.

Your paramount goal in trading is to maintain or increase your account balance. Capital is precious, it is the fuel you need to build the fires that grow your account. With improper sizing your capital can very quickly erode. It is a common misconception that you must take on large positions in order to grow your account. This plays to our natural bias, that we are going to win. We never enter a trade that we think is going to be a loser, so we begin with a bias that we will win. If we are going to win we may as well win big! Unfortunately, going big can also lead to big losses.

Losses Erode an account more quickly than Gains can grow it.

- A 10% loss requires an 11% gain to recover

- A 20% loss requires a 25% gain

- A 30% loss requires a 50% gain

- A 40% loss requires a 66% gain

- A 50% loss requires a 100% gain

- A 60% loss requires 150% gain

- A 70% loss requires a 230% gain

- An 80% loss requires a 400% gain

- A 90% loss requires a 1000% gain.

- A 100% loss is a blowout and will require new capital

As you can see it is more difficult to recover from a loss than it was to take the loss. The deeper the loss it become exponentially more difficult to recover.

Consider a situation. You have taken on an option position on AAPL. We know that AAPL is a perpetual winner and a great stock. However, we got a little excited and bought the position as AAPL was at HOD looking to breakout. However, AAPL did not breakout and instead pulled back. We were so excited at the moment about the inevitable breakout and the money that we were going to make that we loaded the boat. Our account is 90% in AAPL, because it is a perpetual winner. However, our position is now down 30%, resulting in a 27% account drawdown. Here the problem begins, we now need a 50% gain in order to break even. Mentally however, we were initially looking for a 30% gain on the position, so we are trapped thinking that its just going to work out, we’ll get the 30% gain. The trade we wanted to make 30% on now requires us to make 50% in order to not take a loss, but somehow we are now thinking that a gain of 85% (what is required to reach the original target) is inevitable. If this isn’t becoming clear, we just failed to make a 30% gain but somehow we are going to make an 85% gain in the same position?

But it gets worse. Since the original target is obviously going to work out we hold the position open. Some bad news hits for AAPL, a lawsuit over a patent violation, and the position drops further. You are now sitting on a 60% loss. To break even you now need 150% gain to not take a loss. Further this 60% loss is a 54% loss for the account. If you cut here, you would no longer be able to buy the same size that you opened this position with on your next trade. Are you mentally going to be able to cut here, knowing your ability to take your next trade has been deeply impaired? You hold. The losses deepen, and you are now at an 80% loss, 72% of our capital is gone. Your ability to take a new position in the market has been devastated. In order to recover you need a 400% gain. Depression sets in, accompanied by innaction. The stock rebounds and the option contract increases by 200% from your low, leaving you with a 40% loss, you got lucky, but your account took a huge hit.

Now lets consider this from a different approach. The scenario is exactly the same but instead you start with a 10% position. Further lets say it was a $1,000 account, and so your initial position costs $100. This initial drawdown of 30% on the position is a 3% account drawdown. You are unphased and believe in the position so you add, as this is part of your trading plan to scale into the position, your second add is now $70 as the cost is lower, so your total capital exposed is $170, with a value of $140. The further drop occurs another 30% of original value, bringing your value to $80, the value of each position is $40. You again add bring your exposed capital to $210 position value of $120. While your initial is down by 60% overall the position is down by less than 50%. The final drop occurs. Each contract is now worth $20 for a total value of $60. You identify that it has reached support which you new originally might happen and so you now add at the same size as your original $100, this adds 5 contracts to the existing 3 for 8 contracts with a value of $160, your exposure from the beginning at $310. The 200% gain occurs taking the value of each contract to a value of $60. Your position is now worth $480, and you close. Over the cycle you only exposed 31% of your account $310, you achieved a $170 gain, +54% on exposed capital, or 17% on the account. A much better outcome than a 40% account drawdown.

While I don’t recommend the practice of averaging down, if your initial plan is to scale in to the position, meaning that you started small enough to add to a full size, that is a very different situation.

More importantly, the sizing left you capital to take new positions, which may have been in the same trade, or on different trades. And you had the emotional capacity to see the trade through, you expected from the beginning that it might draw down and maintained a margin for error.

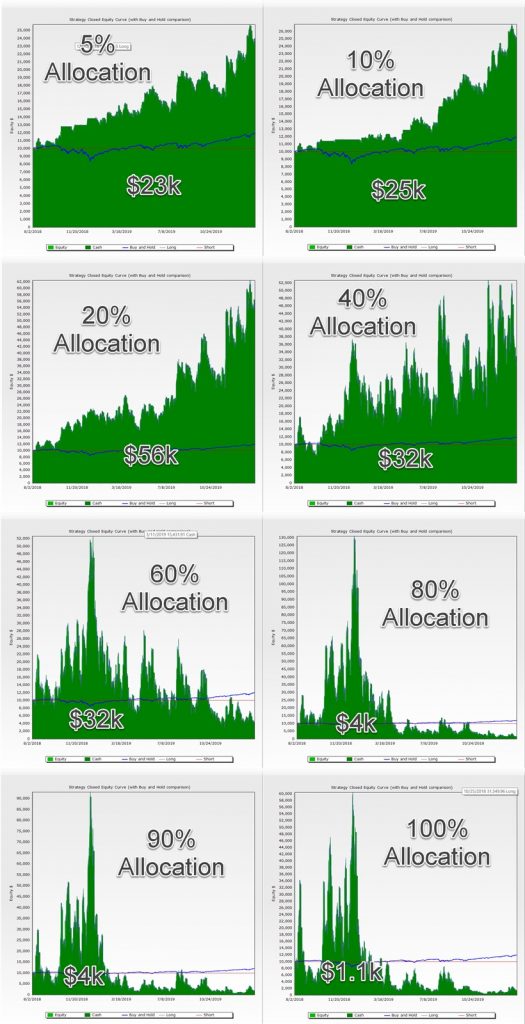

The following image is a set of results from a backtest of a profitable trading strategy. The strategy has a positive expectancy, but it is a volatile strategy. The only variable changed between the results is the size of the allocation relative to the portfolio starting with $10,000. When the allocation is under 40% the results are positive and relatively consistent. With 20% being the sweet spot in this case, 40% is profitable but a bumpy ride.

Moving to 60% is also profitable, it is a seriously wild ride, wild enough it may have just gotten lucky. With the larger 80%, 90% and 100% allocations, the effect is heavy losses on the backs of what were some massive gains. The big money was made, and given back in the end resulting in a loss.

I hope the above information has impressed on you the importance of allocation, particularly when using aggressive strategies. It can be very frustrating when starting with a small account to have someone tell you, that you need to trade even smaller. While 10% gains seem lack luster they build quickly if you are consistent. However heavy losses can flush a small account in a single day. Another day I will talk more about the right size.